Apple Inc, a titan in the technology sector, has long been a focal point for investors worldwide. This analysis delves into the company’s market position, influencing factors, and the potential implications for its stock performance.

Company Overview

Key facts:

Founded: April 1, 1976

Founders: Steve Jobs, Steve Wozniak, Ronald Wayne

Current CEO: Tim Cook (since 2011)

Stock symbol: AAPL (NASDAQ)

Product Portfolio:

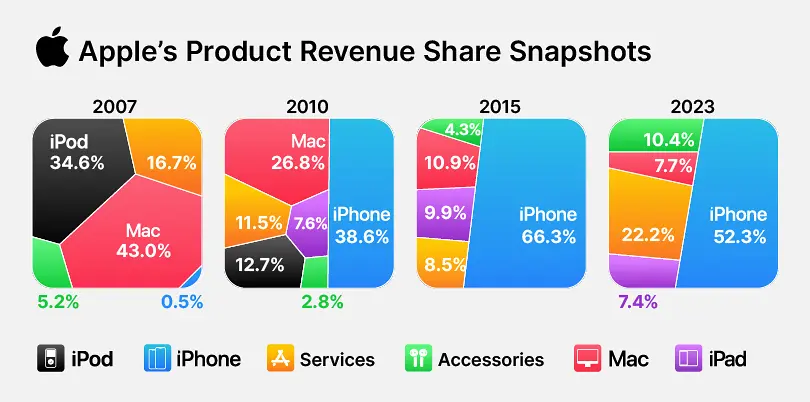

Apple’s revenue streams stem from a diverse range of products and services:

iPhone: Smartphone line

Mac: Personal computer range

iPad: Tablet devices

Wearables, Home, and Accessories: Includes Apple Watch, AirPods, HomePod

Services: App Store, Apple Music, Apple TV+, iCloud, Apple Pay

Historical Milestones

Key Events in Apple’s History:

| Year | Event |

|---|---|

| 1976 | Apple Computer Company founded |

| 1980 | Initial Public Offering (IPO) |

| 1984 | Introduction of the Macintosh |

| 2001 | Launch of iPod and iTunes |

| 2007 | iPhone debut |

| 2010 | iPad released |

| 2015 | Apple Watch introduced |

| 2019 | Launch of Apple TV+ streaming service |

| 2022 | Market cap reaches $3 trillion |

Market Situation

The technology sector, characterized by rapid innovation and intense competition, forms the backdrop for Apple’s operations.

Industry Overview

Key characteristics of the consumer electronics and software industry:

- High research and development expenditure

- Rapid technological advancements

- Short product lifecycles

- Global supply chains

- Intense patent competition

Competitive Landscape

Apple faces competition from various companies across its product lines:

- Smartphones: Samsung, Huawei, Xiaomi

- Personal Computers: Dell, HP, Lenovo

- Tablets: Samsung, Amazon, Microsoft

- Wearables: Fitbit, Samsung, Garmin

- Services: Spotify, Netflix, Google

Apple’s Market Position

Apple’s standing in key product categories:

| Product Category | Market Share |

| Smartphones | 17.2% |

| Tablets | 36.5% |

| Smartwatches | 30.1% |

| Personal Computers | 8.9% |

Note: Market share percentages are approximate and subject to change.

Influencing Factors

Internal Factors

Apple’s core strengths lie in its robust product innovation cycle, backed by substantial R&D investments. Solid financial performance fuels an aggressive corporate strategy, encompassing market expansion and product diversification. The company’s formidable brand strength, characterized by high customer loyalty and ecosystem lock-in, reinforces its market dominance.

External Factors

Macroeconomic conditions and regulatory landscapes significantly influence Apple’s operations. The company navigates evolving technological trends, intense competitive pressures, and geopolitical events that impact global supply chains and international trade dynamics. These external factors continually shape Apple’s strategic decisions and market positioning.

Analyst Opinions

Financial analysts offer varied perspectives on Apple’s stock performance. Here’s a synthesis of recent analyst views:

Bullish Perspective: John Smith, Global Tech Insights

“Apple’s ecosystem strategy and services growth present significant upside potential. The company’s ability to maintain high margins and customer loyalty suggests a strong long-term outlook.”

Key points:

Price target: $250

Rating: Buy

Catalyst: Services revenue growth and new product categories

Cautious Outlook: Sarah Johnson, Market Dynamics Research

“While Apple’s brand strength is undeniable, market saturation in key product categories and increasing regulatory scrutiny pose challenges. Investors should monitor these factors closely.”

Key points:

Price target: $200

Rating: Hold

Concerns: Smartphone market saturation and potential regulatory headwinds

Bearish View: Michael Chen, Tech Sector Analytics

“Apple’s reliance on the iPhone for a significant portion of its revenue creates vulnerability. The company needs to demonstrate stronger growth in non-iPhone categories to justify its current valuation.”

Key points:

Price target: $180

Rating: Underperform

Issues: iPhone dependency and challenges in emerging markets

Table: Analyst Recommendations Summary

| Analyst | Rating | Price Target |

|---|---|---|

| John Smith | Buy | $250 |

| Sarah Johnson | Hold | $200 |

| Michael Chen | Underperform | $180 |

Prospects and Risks

Evaluating Apple’s future requires consideration of both growth opportunities and potential challenges.

Growth Factors

Services Expansion

Potential for high-margin recurring revenue

Cross-selling opportunities within the ecosystem

Emerging Markets

Untapped smartphone markets in developing countries

Growing middle class in markets like India and Southeast Asia

Wearables and Accessories

Continued growth in Apple Watch and AirPods segments

Potential for new wearable technology categories

5G Adoption

Upgrade cycle driven by 5G-capable devices

Increased data consumption benefiting services segment

Healthcare Technology

Integration of health monitoring features in devices

Potential partnerships with healthcare providers

Risk Factors

Market Saturation

Slowing growth in mature smartphone markets

Challenges in maintaining high market share

Supply Chain Disruptions

Dependency on specific component suppliers

Geopolitical risks affecting manufacturing

Regulatory Challenges

Antitrust investigations in multiple jurisdictions

Potential changes to App Store policies and revenue model

Technological Shifts

Emergence of disruptive technologies

Failure to anticipate or adapt to new trends

Economic Downturns

Reduced consumer spending on premium products

Currency fluctuations impacting international sales

How to Buy Apple Shares

For investors interested in purchasing Apple stock, here’s a step-by-step guide:

1. Choose a Brokerage

– Consider factors like fees, research tools, and user interface

– Options include traditional brokers and online platforms

2. Open an Account

– Provide necessary personal information

– Complete identity verification process

3. Fund Your Account

– Transfer money from your bank account

– Consider starting with a smaller investment to familiarize yourself with the process

4. Place an Order

– Decide between market orders (buy at current price) or limit orders (set a maximum price)

– Determine the number of shares or dollar amount to invest

5. Monitor Your Investment

– Keep track of Apple’s financial reports and news

– Consider setting up alerts for significant price movements

Conclusion

Table: Apple Stock Analysis Summary

| Aspect | Assessment |

|---|---|

| Financial Strength | Strong |

| Market Position | Market Leader |

| Growth Potential | Moderate to High |

| Risk Level | Moderate |

| Analyst Consensus | Cautiously Optimistic |

Investors considering Apple shares should:

1. Evaluate their risk tolerance and investment goals

2. Consider Apple’s position within a diversified portfolio

3. Stay informed about industry trends and company developments

4. Be prepared for potential volatility in the tech sector

FAQ

How does Apple’s dividend policy affect its stock value?

Apple pays a quarterly dividend, which can attract income-focused investors. The company’s dividend policy, combined with its share buyback program, signals confidence in its financial stability and can support the stock price.

What impact does the iPhone product cycle have on Apple’s stock performance?

iPhone releases typically follow an annual cycle. The stock often experiences increased volatility around new iPhone announcements and initial sales reports, as the iPhone contributes significantly to Apple’s revenue.

How might changes in US-China relations affect Apple’s stock?

US-China relations can impact Apple’s stock due to the company’s reliance on Chinese manufacturing and the Chinese consumer market. Trade tensions or policy changes could affect production costs, supply chain efficiency, and sales in the Chinese market.