Intel Corporation, founded in 1968, is a prominent technology company specializing in semiconductor chip manufacturing. Based in Santa Clara, California, Intel has been a key player in the computer industry for decades.

Key Company Facts

Founded: July 18, 1968

Founders: Gordon Moore, Robert Noyce

Primary Focus: Semiconductor chip manufacturing

Product Portfolio:

Central Processing Units (CPUs)

Chipsets

Integrated Graphics Processing Units (iGPUs)

Network Interface Controllers

Flash Memory

Field-Programmable Gate Arrays (FPGAs)

Historical Milestones:

1971: Developed world’s first commercial microprocessor

1990s: Partnership with Microsoft (“Wintel”) shaped PC industry

2000s: Faced increasing competition from AMD

2020s: Focus on AI, autonomous driving, and advanced manufacturing

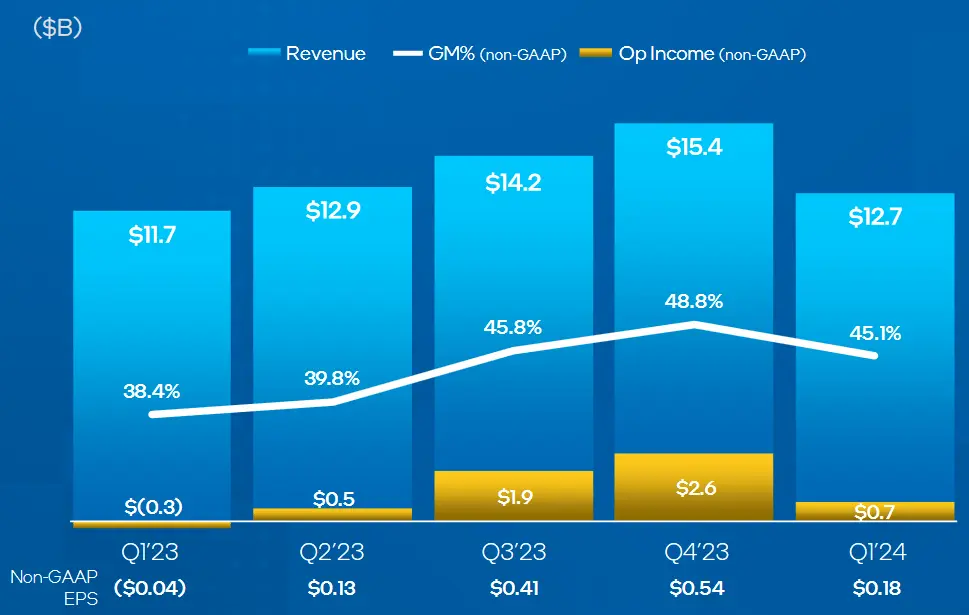

Market Situation

Intel operates in the highly competitive semiconductor industry, crucial for technological advancements across various sectors.

Industry Characteristics:

- Rapid technological advancements

- High research and development costs

- Cyclical demand patterns

- Global supply chain dependencies

Market Position (as of 2023):

- x86 market share: 68.4%

- Global semiconductor market ranking: Fluctuating between 1st and 2nd

Key Competitors:

- Advanced Micro Devices (AMD)

- NVIDIA

- Qualcomm

- TSMC

- Samsung Electronics

| Competitor | Strength | Weakness |

|---|---|---|

| AMD | Strong in desktop CPUs | Smaller market share |

| NVIDIA | Dominates GPU market | Limited CPU presence |

| Qualcomm | Leader in mobile chips | Less presence in PC market |

| TSMC | Advanced manufacturing | Not a direct chip designer |

| Samsung | Diverse tech portfolio | Less focused on CPUs |

Influencing Factors

Internal Factors:

Research and Development (R&D) Investments

Annual R&D spending: $15.19 billion (2020)

Focus areas: AI, 5G, quantum computing

Manufacturing Capabilities

Intel 3 process node in production

Plans for Intel 20A and 18A nodes

Strategic Acquisitions

Notable acquisition: Mobileye (autonomous driving)

Value: $15.3 billion (2017)

Product Diversification

Expansion into discrete GPUs (Intel Arc)

Development of AI accelerators (Gaudi)

External Factors:

Global Chip Shortage

Impact: Increased demand, supply constraints

Duration: Expected to last through 2024

Geopolitical Tensions

US-China trade relations

Impact on global supply chains

Technological Advancements

Shift to ARM-based architectures

Quantum computing developments

Economic Conditions

Inflation rates

Consumer spending patterns

Analyst Opinions

Michael Johnson, Tech Industry Analyst at Global Insights:

“Intel’s strategic shift towards AI and advanced manufacturing processes positions them well for future growth. The company’s vast resources and established market presence provide a solid foundation for innovation.”

Rating: Buy

Price Target: $45

Key Points:

- Strong potential in AI market

- Improving manufacturing capabilities

- Undervalued at current price levels

Sarah Williams, Senior Analyst at MarketWatch:

“While Intel faces significant challenges from competitors, their recent investments in foundry services and next-generation technologies show promise. However, execution risks remain.”

Rating: Hold

Price Target: $38

Key Points:

- Competitive pressures from AMD and NVIDIA

- Potential in foundry services

- Execution risks in new technology rollouts

David Chen, Semiconductor Specialist at TechTrends:

“Intel’s turnaround strategy under CEO Pat Gelsinger is ambitious but faces significant hurdles. The success of their IDM 2.0 strategy is crucial for long-term competitiveness.”

Rating: Neutral

Price Target: $40

Key Points:

- IDM 2.0 strategy implementation critical

- Potential in AI and edge computing

- Market share pressures in core CPU business

Prospects and Risks

Growth Factors:

AI and Data Center Expansion

Projected AI chip market size: $300 billion by 2026

Intel’s AI PC shipments: 5 million units (2023)

Foundry Services (Intel Foundry Services)

Potential to capture market share from TSMC and Samsung

US CHIPS Act support: $52 billion in subsidies

Edge Computing and IoT

Projected IoT market size: $1.6 trillion by 2025

Intel’s IoT Group revenue: $4 billion (2020)

Autonomous Driving (Mobileye)

Projected autonomous vehicle market: $556.67 billion by 2026

Mobileye revenue growth: 41% YoY (Q4 2023)

Risks:

Intense Competition

AMD’s market share gains in desktop and server CPUs

NVIDIA’s dominance in AI and GPU markets

Manufacturing Delays

Historical issues with 10nm and 7nm processes

Potential impact on product competitiveness

Technological Shifts

Rise of ARM-based architectures in PCs and servers

Quantum computing advancements

Geopolitical and Economic Uncertainties

Global chip shortage impact

US-China trade tensions

How to Buy Intel Shares

1. Choose a Brokerage

Options: Interactive Brokers, Charles Schwab, Fidelity

Factors to consider: Fees, research tools, user interface

2. Open an Account

Required information: Personal details, financial information

Verification process: Identity and address confirmation

3. Fund Your Account

Methods: Bank transfer, wire transfer, check deposit

Minimum deposit: Varies by broker (typically $100-$2000)

4. Place an Order

Intel stock symbol: INTC (NASDAQ)

Order types: Market order, limit order, stop order

5. Monitor Your Investment

Tools: Broker’s dashboard, financial news sources

Key metrics: Earnings reports, analyst ratings, industry news

Conclusion

Intel Shares Assessment:

| Factor | Rating (1-5) | Notes |

|---|---|---|

| Financial Health | 4 | Strong balance sheet, consistent revenue |

| Market Position | 3 | Facing increased competition |

| Innovation | 4 | Significant R&D investments |

| Growth Potential | 3 | Opportunities in AI and foundry services |

| Risk Level | 3 | Manufacturing challenges, market shifts |

Investor Recommendations:

- Short-term: Cautious approach due to market volatility

- Medium-term: Monitor progress of IDM 2.0 strategy

- Long-term: Potential for growth with successful execution of AI and foundry plans

FAQ

How does Intel’s dividend compare to its competitors?

Intel’s dividend yield is currently around 1.4%. This is lower than some competitors like Texas Instruments (2.6%) but higher than others like NVIDIA (0.1%). Intel has a history of consistent dividend payments, having increased its dividend for several consecutive years.

What is Intel’s strategy to compete in the AI chip market?

Intel is focusing on several areas to compete in the AI chip market:

1. Development of specialized AI accelerators (Gaudi line)

2. Integration of AI capabilities into mainstream CPUs (Core Ultra series)

3. Investment in software ecosystems to support AI workloads

4. Partnerships with AI companies and research institutions

How might the CHIPS Act impact Intel’s future performance?

The CHIPS Act could significantly benefit Intel:

1. Provides $52 billion in subsidies for semiconductor manufacturing

2. Supports Intel’s plans to expand US-based manufacturing facilities

3. May enhance Intel’s competitive position against foreign chip makers

4. Could accelerate Intel’s progress in advanced manufacturing processes